The History of Empire

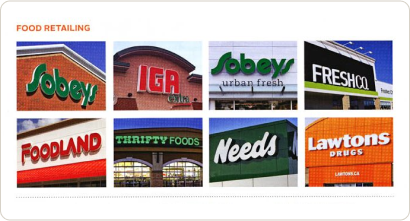

Empire Company Limited is a Canadian company headquartered in Stellarton, Nova Scotia. Empire’s key businesses are food retailing and related real estate.

Empire’s Food retailing segment is carried out through Sobeys, a wholly-owned subsidiary. Proudly Canadian, with headquarters in Stellarton, Nova Scotia, Sobeys has been serving the food shopping needs of Canadians since 1907.

In June 2020, empire company limited introduces the future of online grocery home delivery to the greater Toronto area. Voila by Sobeys is powered by Ocado group plc’s industry-leading technology and fills orders through its state-of-the-art automated Customer Fulfillment Centre in Vaughan, Ontario. Voilà customers can shop for thousands of fresh produce and grocery products from Sobeys alongside customer favourites from Farm Boy, and health, wellness, baby, pet and beauty products from Well.ca. Voilà has since expanded to new markets in Alberta and Quebec.

In March 2021, Empire acquires a 51% stake in Longo's, a long-standing, family-built network of specialty grocery stores in the GTA of Ontario, and the Grocery Gateway e-commerce business for an acquisition price of $357 million. The transaction adds 26 Longo’s store to Empire’s expanding Ontario footprint.

In June 2022, Empire marks an important milestone in our loyalty and customer experience journey with announcement if its new co-ownership of Scene+ one of Canada's leading loyalty rewards programs. The new strategy to thrill, reward and connect with customers through Scene+ brings together three iconic Canadian companies to transform the Scene+ program into a preeminent loyalty program in Canada.

Empire Company Limited was incorporated on February 12, 1963.

Empire Company issues its first annual report, January 31, 1971.

Purchased Lawtons Drug Stores Limited, which operates 18 retail drug stores in Nova Scotia.

In November ’80 and June ’81, Empire acquires control of Sobey Stores Limited through purchase of Sobey Holdings Limited. Empire issued a combination of cash and Non-Voting shares to the shareholders of Sobey Holdings Limited for consideration of this purchase. Empire, together with its current Non-Voting shareholdings in Sobeys, now controls 95% of Sobeys Voting shares and a combined 50.97% equity interest in Sobeys.

In January 1982, Empire shares split on a 2.5 for 1 basis. On July 9, 1982, Empire becomes a public company issuing Non-Voting Class A shares on the Toronto Stock Exchange.

In February 1983, Empire increases its ownership in Hannaford Bros. Co. (a U.S. food retailer) to 25%. In December, Empire shares split on a three for two basis.

December 1985 marked the death of Frank H Sobey.

January 1986, Empire shares split on a two for one basis. In April, revenue reaches the $1 billion mark for the first time in the Company’s history. Net earnings of $12.3 million. In October, Empire shares split on a two for one basis.

In June 1987, Empire purchases the outstanding public float of Sobey Stores Limited, making it a 100% subsidiary of Empire. Also in June, Empire acquires Famous Players’ 50% interest in Empire Theatres joint venture operations, making this a 100% owned subsidiary.

In May 1988, Empire holds a 25% interest in Provigo. Empire purchases an additional 22% interest in Wajax resulting in a total of 45%.

In May 1989, William M. Sobey, the eldest son of Frank H. Sobey, passed away. In June, Empire repurchases the public interest in Atlantic Shopping Centres, making it once more a 100% owned subsidiary, for $22 million paid in Non-Voting shares of Empire.

In December 1993, the real estate division increases it ownership of Halifax Developments Limited to 100% from 36% at a cost of $12.7 million.

In December 1998, after acquiring the Oshawa Group for $1.5 billion, Sobeys Inc. became a public company on the Toronto Stock Exchange, with Empire owning a 62% interest in Sobeys.

In February 1999, Empire issues 2 million Non-Voting Class A shares for $58 million.

In March 2000, Empire repurchases 5.5 million of its Non-Voting Class A shares for $187 million. In July, Empire sells its 25% investment in Hannaford Bros. Co. for $1.03 billion.

In January 2001, the real estate division purchases a 35.7% interest in Genstar Development Partnership for $29 million.

In March 2002, Sobeys sells its Serca Foodservice operation to SYSCO for $411 million.

In February 2004, Sobeys acquires Commisso’s Food Markets for $61 million and the real estate division acquires Commisso’s real estate assets for $42.5 million.

In June 2005, Wajax converts to an income trust. Empire sells 2.875 million units, for a $50.8 million. In September, Empire Theatres acquires 27 movie theatres for $83 million.

In March 2006, Crombie REIT completes its initial public offering. Empire sells 44 properties to the REIT for $468.5 million and retains a 48.3% ownership interest. In August 2006, Sobeys acquires Achille de la Chevrotière Ltée, which included 25 stores in northern Québec and Ontario as well as a distribution centre in Rouyn-Noranda for $79.2 million.

In June 2007, Sobeys celebrates its 100th birthday and Empire acquires the outstanding common shares of Sobeys that it did not own for $1.06 billion, resulting in a 100% ownership position. In September, Sobeys acquires Thrifty Foods for $253.6 million. Thrifty’s assets include 20 full-service supermarkets, a distribution centre and a wholesale division on Vancouver Island and the lower mainland of British Columbia.

In April 2008, Empire sells 61 properties for $428.5 million to Crombie REIT.

In April 2009, Empire issues 2,713,000 Non-Voting Class A shares at $49.75 per share for total net proceeds to Empire of approximately $129 million.

Sobeys enjoys another record year and receives credit rating upgrades from Standard & Poor’s and DBRS, with both ratings at investment grade.

Empire sells its investment in Wajax Income Fund for net proceeds of $121.3 million. Sobeys completed the first year of the FreshCo discount banner in Ontario with a network of 57 stores in operation by year-end and more to come in fiscal 2012.

Sobeys initiates an organizational realignment to optimize productivity and fully capitalize on scale. Sobeys purchases 236 retail gas locations for $214.9 million in Québec and Atlantic Canada.

In September 2013, Sobeys introduces the Better Food For All movement to Canadians.In November 2013, Empire and Sobeys completes its purchase of substantially all of the assets of Canada Safeway for a cash purchase of $5.8 billion. Also, Empire Theatres completes the sale of 46 theatres with 397 screens in separate transactions with Cineplex Inc. and Landmark Cinemas. The aggregate gross purchase price paid to Empire Theatres in the two transactions was approximately $248 million in cash.

In March 2015, Sobeys becomes the first Canadian grocer to issue AIR MILES reward miles across Canada.

In January 2018, Sobeys announces an agreement with Ocado Group plc to bring the world’s leading online grocery ordering, automated fulfillment and home delivery solution to Canada. In July 2018, built on the foundation of Sobeys’ strong history, rich family culture and deep rooted values, the company introduces its new purpose – We are a family nurturing families. In December 2018, Empire acquired Farm Boy – one of the most exciting, fastest growing and successful food retailers in Canada – for a total purchase price of $800 million. At acquisition, Farm Boy had a network of 26 stores in Ontario, and a distribution centre in the city of Ottawa, with plans to double their store count in the next five years.

In April 2019, Sobeys expands its discount banner outside of Ontario to Western Canada, announcing the opening of the first Western FreshCo store in Mission, British Columbia. The Company has announced plans to open additional FreshCo stores in Western Canada through the conversion of up to 25% of its 255 Safeway and Sobeys full service stores, over the course of the next four years.

In June 2020, empire company limited introduces the future of online grocery home delivery to the greater Toronto area. Voila by Sobeys is powered by Ocado group plc’s industry-leading technology and fills orders through its state-of-the-art automated Customer Fulfillment Centre in Vaughan, Ontario. Voilà customers can shop for thousands of fresh produce and grocery products from Sobeys alongside customer favourites from Farm Boy, and health, wellness, baby, pet and beauty products from Well.ca. Voilà has since expanded to new markets in Alberta and Quebec.

In March 2021, Empire acquires a 51% stake in Longo's, a long-standing, family-built network of specialty grocery stores in the GTA of Ontario, and the Grocery Gateway e-commerce business for an acquisition price of $357 million. The transaction adds 26 Longo’s store to Empire’s expanding Ontario footprint.

In June 2022, Empire marks an important milestone in our loyalty and customer experience journey with announcement if its new co-ownership of Scene+ one of Canada's leading loyalty rewards programs. The new strategy to thrill, reward and connect with customers through Scene+ brings together three iconic Canadian companies to transform the Scene+ program into a preeminent loyalty program in Canada.

Empire Company Limited was incorporated on February 12, 1963.

Empire Company issues its first annual report, January 31, 1971.

Purchased Lawtons Drug Stores Limited, which operates 18 retail drug stores in Nova Scotia.

As Empire has grown and evolved over the decades, its businesses and subsidiaries continue to thrive. To learn more, click a link below for information; from the Sobeys Inc. timeline to the details of Empire businesses.

The History of Sobeys Inc.

Real Estate Businesses

Sustainable Business Report